5 Best Mortgage Lenders Of August 2023

February 7th, 2022

Reverse mortgages and home equity loans are also available, as are zero-down payment options. The lender publishes its rates for their different loans online, making it easy to compare options. Mortgage rates change almost daily and can depend on market forces such as inflation and the overall economy. However, your specific mortgage rate will depend on your location, credit report and credit score.

Guaranteed Rate is a Chicago-based lender that has a strong online presence and 400 branch locations across the country. It offers conventional mortgage purchase loans as well refinances and the full range of government-sponsored loans. Guaranteed Rate provides home equity lines of credit, or HELOCs, but not home equity loans. But there’s a lot more than rates when it comes to choosing the best mortgage lender. The top picks were selected based on factors like quality of service (weighted 50%), operational features (32%), loan types (12%), and accessibility (6%).

Summary: Best mortgage lenders of August 2023

If your credit improves or mortgage rates decrease, you may be wondering if you can refinance to take advantage of lower rates. Mortgage refinancing is possible, but the process can be intensive—similar to applying for the original mortgage—and may require you to pay closing costs. Caliber Home Loans is a lender best suited for borrowers looking for mortgage solutions for particular situations. The lender offers conventional and government-backed loans—including FHA, VA, and USDA loans—but it also has unique products specifically designed for certain borrowers. For example, self-employed borrowers can take advantage of the lender’s SmartSelf loan and qualify for a mortgage with their bank statements rather than needing two years of tax returns. Fairway doesn’t list its minimum credit score requirements on its site, but a loan officer told us the minimum score for most loans is usually 620.

3 ways to get a good mortgage rate even when rates are high – CBS News

3 ways to get a good mortgage rate even when rates are high.

Posted: Mon, 10 Jul 2023 07:00:00 GMT [source]

Because rates fluctuate frequently, it’s best to get these quotes on the same day so you have an accurate basis of comparison. All other things being equal, the shorter your loan term is, the lower your interest rate will be. So a 15-year fixed-rate mortgage should have a lower rate than a 30-year fixed-rate mortgage. If you want the lowest mortgage rate available, you have to shop around.

Closing costs will vary by location and typically run from 2% to 4% of the home’s purchase price. Based in Virginia, Navy Federal Credit Union serves all 50 states and the District of Columbia with 344 branches worldwide. Navy Federal’s field of membership goes beyond current and retired members of the armed forces to include their families and household members, as well as certain government contractors.

Credit reporting agencies recognize this as shopping around for the best mortgage rate. The lender also offers a One-Day Mortgage — which allows customers to lock in a rate, submit their financial details and obtain a commitment letter stating they’ve been approved for a mortgage within 24 hours. You can also take advantage of the Better Price Guarantee, which promises to match any valid competitor’s offer and credit you $100 — if they can’t match the price, you get to keep the $100. The lender offers free online credit counseling through its Lighthouse Program, which pairs customers with a credit specialist who helps them map out a credit score improvement plan.

Best mortgage lenders of August 2023

Two lenders can advertise the same mortgage rate but charge wildly different closing fees. A low rate with high closing costs can eat away at the savings you thought the low rate provided. The company doesn’t disclose origination fees online because it varies by state, but the lender does charge a $395 application fee that will be refunded as a credit once you close.

- The home-buying process can seem daunting for first-time homebuyers.

- You can also compare the rates lenders are offering to national benchmark rates, such as those published by Freddie Mac.

- But Veterans United also offers an array of terms and loan products, in addition to competitive rates.

The top mortgage lenders were highly rated based on scores from our rigorous Motley ratings methodology, and mortgage specific rating methodology. A 15-year mortgage gives homeowners 15 years to pay off their mortgage in fixed, equal amounts plus interest. By contrast, a 30-year mortgage gives homeowners 30 years to pay off their mortgage. With a 30-year mortgage, your monthly payments will be lower since you’ll have a longer period of time to pay off the loan. However, you’ll wind up paying more in interest over the life of the loan since interest is charged monthly. A 15-year mortgage lets you save on interest but you will likely have a higher monthly payment.

Why some lenders didn’t make the cut

Ally is limited in loan options compared to competitors, but it’s all about efficiency and a speedy online experience. Ally states that applicants can get pre-approved in as little as three minutes and loans close up to 10 days faster than the industry average. Applicants with credit scores as low as 500 can qualify for a FHA loan with a 10% down payment.

How to choose the best home equity product for you – CBS News

How to choose the best home equity product for you.

Posted: Mon, 07 Aug 2023 20:10:07 GMT [source]

Despite the lower rate predictions, high home prices and high rates are keeping homebuyer and homeowner refinance plans on the sidelines. A lack of supply and persistently steep home prices are best lenders for mortgages making it hard for many would-be homebuyers, according to Jacob Channel, senior economist for Lendingtree. Another good idea is getting a mortgage pre-approval before deciding on a property.

Best for Low Credit Scores

LoanDepot, however, doesn’t offer USDA loans, home equity loans or HELOCs. To qualify with Citibank, borrowers will need a credit score of at least 620 for conventional loans, 680 for jumbo loans and 620 for FHA and VA loans. Citibank offers down payments as low as 3% through its HomeRun Mortgage.

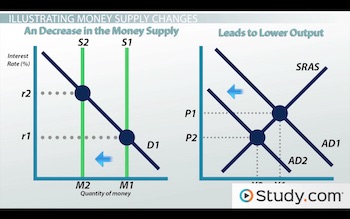

If you’re a member at some local banks, you may be able to receive special relationship discounts on your home loan just for having an existing account that reaches any potential balance requirements. This can be advantageous since it allows you to save money on your mortgage. If you’re considering a local bank where you’re already an existing customer, be sure to ask about relationship discounts. While the Federal Reserve doesn’t set mortgage rates, mortgage rates tend to move in reaction to actions taken by the Federal Reserve on its interest rates. Most lenders sell their mortgages after closing to maintain liquidity and allow them to continue lending mortgages. Most lenders don’t offer every type of mortgage that’s out there.

Most mortgage lenders look for a minimum credit score of 620 but Rocket Mortgage accepts applicants with lower credit scores at 580 for some loan options. In picking the best of the best, we looked for lenders that satisfied our methodology criteria and had offerings to meet the needs of a wide variety of borrowers. Some of the ones that didn’t make our list had weaknesses like having limited loan options or ranking low in customer satisfaction. Caliber also has a low minimum credit score requirement and accepts non-traditional credit information when evaluating loan applications. Caliber says borrowers with this alternative credit data can secure down payments as low as 3% on conventional loans. Rocket is one of the largest retail lenders in the country by loan volume, offering a variety of mortgage options, including conventional mortgages, FHA, VA and jumbo loans.

Best National Bank: Bank of America

Borrowers can get conventional, jumbo, FHA and refinancing loans as long as they have a minimum credit score of 620. There are no lender fees on home loans at Better Mortgage, and the company offers a “Better Price Guarantee,” which promises to match competitors’ offers and provide a $100 credit toward closing costs. Compare mortgage rates and other loan elements such as fees, terms, time to close, the availability of online application and loan tracking, and customer service offerings.

If you have a good financial profile but a lender is charging you a higher rate than today’s national average, you may want to look elsewhere. The best lenders typically offer low fees and responsive customer service. Two costs that can vary widely between lenders are origination fees and discount points, according to Rebecca Richardson aka The Mortgage Mentor. Borrowers should primarily focus on these expenses as third-party fees like appraisal and title fees won’t vary much. Additionally, a PNC loan officer will work with borrowers that have credit scores below 620 to find the best mortgage option.

Look closely at the rates, fees and other requirements to see which mortgage lender is offering you the best deal. We compared 30-year mortgage rates from the 30 biggest lenders in 2022 (the most recent data available). In our study, Better had the lowest mortgage rates overall while Navy Federal Credit Union had the best mortgage rates for a VA loan.

Remember that most people who get a 30-year mortgage don’t keep their loan the full 30 years. In fact, homeowners keep 30-year loans for just seven years on average. And when you’re only paying interest over a short period, those upfront fees start to carry more weight compared to your interest rate. Your interest rate might seem much more important because it’s with you for the life of the loan and it helps determine your monthly mortgage payment. But upfront fees can make a big difference, especially if you’ll only be in the house a few years. It’s just as important to compare upfront loan costs as it is to compare mortgage rates.

Before buying a home, tapping equity or refinancing a mortgage, shop around to find some of the best mortgage lenders for your circumstances. Knowing when rates are rising or falling can help you decide when to lock a rate, especially if you’re refinancing. And it can give you some idea of how competitive your own rates are compared to the overall market. Each application may trigger a hard inquiry on your credit reports, but credit-scoring companies know consumers shop around. Experian will treat all mortgage inquiries made within 30 days as just one inquiry.

- The most reliable way to find the best mortgage lender is to pick out a few different lenders that offer loans and features you’re looking for and get preapproved with each of them.

- Navy Federal’s field of membership goes beyond current and retired members of the armed forces to include their families and household members, as well as certain government contractors.

- A mortgage lender is a financial institution that finances the home loan for a fee.

- Refinancing is another popular loan product some homeowners inquire about, which can lower the interest rate of your current mortgage.

It also features reviews so users can read about experiences other customers have had with each lender. Finally, if you’re looking for a low down payment, Rocket has options — some loans allow first-time homebuyers to put as little as 3% down. The lender also recently introduced a 1% down loan option, called One+, for borrowers who earn 80% or less of the area median income and meet qualifying income requirements. Our picks offer competitive interest rates and a range of loan products that cater to different needs. They also have simple mortgage pre-qualification, pre-approval and application processes and a strong customer satisfaction record. Loans backed by the Federal Housing Administration can be beneficial to borrowers with lower credit scores because FHA loans tend to allow lower minimum credit scores.

If you enjoyed this post, make sure you subscribe to my RSS feed!