Types of Synergies in M&A Transactions Overview, Examples, Types

February 9th, 2022 | No Comments »

The merger of the two companies can give Company A access to the European distribution networks while Company B will gain access to the North American distribution networks. This will result in cost savings since the new entity will be able to distribute more products using the existing networks. The company will also achieve strong bargaining power when sourcing products from suppliers. Cost synergy is the expected cost savings on operating expenses from the merger of two companies.

Two organizations that work together produce more significant value than their respective values combined. Say, each company’s value is 2, then their synergy can create value greater than 4. But without clearly identified and quantified synergies, most acquisitions simply do not make financial sense. Accurately articulating the financial value of specific synergies is a must for both buyers and sellers. Goodwill is the intangible asset that is gained with one company’s acquisition of another company.

SYNERGIES

A detailed description of these synergies likely will increase the value of your company in the eyes of an acquirer. Even experienced buyers may not readily see all of the potential synergies in acquiring your business. You are well served to present types of synergy a compelling case to your buyer of all the areas they can benefit by acquiring your business. In simple terms, a Discounted Cash Flow is a method of valuation used to calculate the value of an investment based on its expected future cash flows.

Below is a nice visual logic tree that outlines the various sources of synergy, which you can use to better evaluate potential options. Below is a screenshot from CFI’s M&A Modeling Course where you can see the synergistic impact of an acquisition. Post-close synergy work needs to be planned early and carried on months, sometimes even years, after a close.

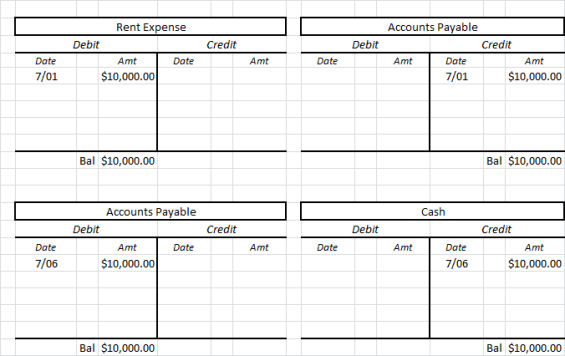

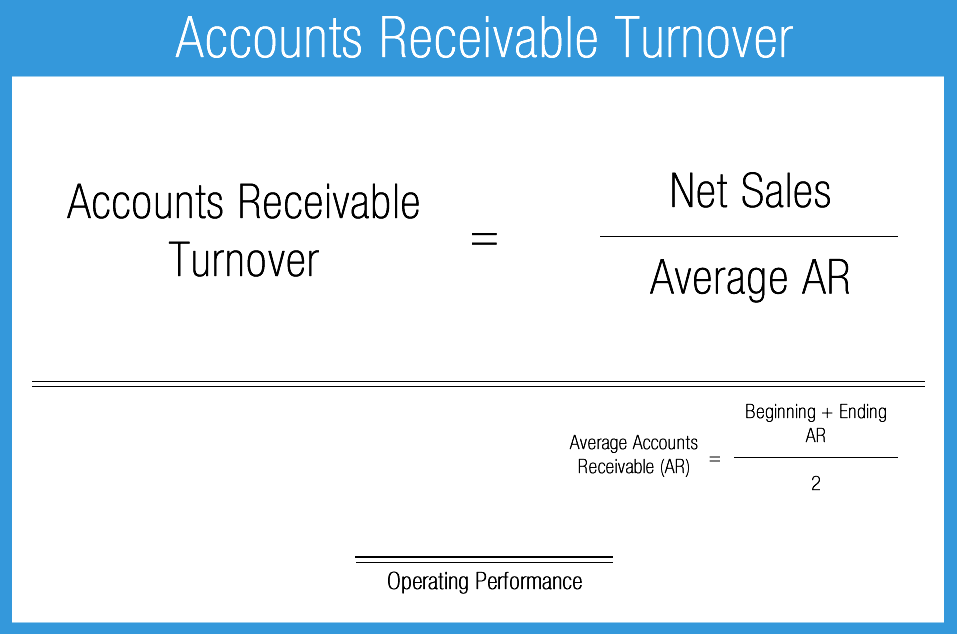

Concept of Synergy & Types

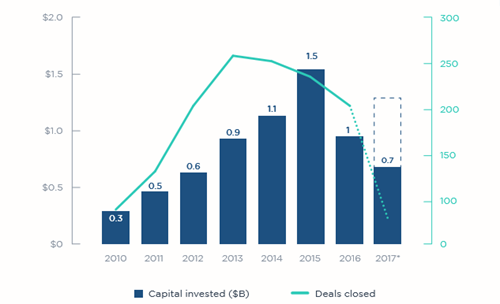

There is a financial component that drives consolidation but there is a strategic component as well. Consolidation in the entire automotive aftermarket industry will likely continue due to both components. Prolonged increases in interest rates may have an impact on valuations over the medium term but likely not a significant impact immediately. Capital synergies are created primarily by combining two or more entities and selling off excess capital such as property, plant, and equipment, with the intent of increasing the utilization of the remaining capital. Realizing capital synergies also creates cost synergies, through the elimination of maintaining and operating the eliminated capital. Increasing leverage over customers, suppliers, and partners can also create capital synergies through improved terms for accounts payable and accounts receivable.

- The large company can leverage the small company’s established distribution and presence in the emerging market.

- It occurs when a company acquires another company, and the goodwill represents the value of expected future growth as a result of the transaction.

- When two companies merge, there is a reorganization of the management teams.

- It is important to be conservative once you start calculating and estimating potential value generated from synergies.

- In addition to merging with another company, a company may also attempt to create synergy by combining products or markets.

- Firms get benefits since they have a better cash flow and capital structure and, thus, are more likely to repay their loan on time.

Synergy is the concept that the whole of an entity is worth more than the sum of the parts. This logic is typically a driving force behind mergers and acquisitions (M&A), where investment bankers and corporate executives often use synergy as a rationale for the deal. In other words, by combining two companies in a merger, the new company’s value will be greater than the sum of the values of each of the two companies being merged. Whether you are evaluating an acquisition, or have been approached by a consolidator and are considering a sale, the importance of developing a “pro forma” financial model cannot be understated.

EXPLORE OTHER TYPES OF STRATEGY

The deal would have saved Pfizer billions in annual tax returns, until the US government stepped in and prohibited the deal on that same basis. Cooperation between a developer with a marketer in developing a web is another example. The marketer develops communicative and exciting messages, while the developer translates them into programs.

Increased revenue for the combined companies comes from increased product coverage or an increased ability to provide services to sell through a distribution network. Also, the company will have an increased number of sales representatives who can sell twice as many products. Revenue synergies arise when two combined companies can achieve more sales than the sum of their sales individually. As a result, the new firm generates higher revenue than the two firms would have been able to accomplish on their own. There are four main types of synergies, including revenue, cost, capital, and other financial synergies.

Define the three types of synergy that may result from mergers. What are the sources of these…

The term is mostly used in mergers and acquisitions (M&A), where two companies merge to form one company that can generate more revenues or streamline the two companies’ operations and save on costs. In some cases, combining companies can result in financial advantages the stand-alone companies would be otherwise unable to achieve individually. For example, smaller companies generally have to pay a premium when borrowing money relative to larger companies. However, two mid-sized companies can merge and lower their combined cost of capital more than they could individually. There may also be unique tax benefits and possibly an increased debt capacity as a result of merging that would otherwise be unavailable.

- Consolidation in the industry will continue, even in the face of increasing rates, because the financial opportunities far outweigh increased borrowing costs in the short term.

- Thus, the value of goodwill must account for the expected future cash flows, growth rates, revenues, and company capital cost.

- Hero Honda Ltd was a joint venture between Hero Cycles of India and Honda Motor of Japan.

- It is one thing to say there are cost synergies due to redundant processes and systems, yet realizing those cost synergies can be an absolute nightmare.

- A revenue synergy is when, as a result of an acquisition, the combined company is able to generate more sales than the two companies would be able to separately.

- Mergers & acquisitions, partnerships, and consolidations are primarily about by the value created from the synergies between two or more entities.

This is harder to estimate than revenue and cost synergies, but it’s an essential component of M&As. The three main types of synergies are financial synergies, revenue synergies, and cost synergies. Financial synergy basically includes revenue and cost synergies and improves a combined company’s position in the market. Synergies are an integral part of mergers and acquisitions (M&A) transactions when the seller seeks beneficial offers from strategic buyers and private equity firms. Understanding the types of synergies in mergers and acquisitions, analyzing them on paper, and maximizing them once the deal has gone through, are essential to getting the most from your M&A transactions. Synergies mean the increase in the value of a merged entity beyond the combined value of two separate firms.

The company will also benefit from a larger number of sales representatives to sell more products than they previously owned before the merger. Also, the merged company will incur fewer costs of marketing and distribution due to the corporate synergies. When two companies merge, they often become synergistic by virtue of generating more revenues than the two independent companies could produce on their own. The merged company may gain access to more products and services to sell through an extensive distribution network. The main goal of cost synergies in mergers and acquisitions is cost reduction or cost savings.

Merging companies that bundle complementary products can generate more revenue. They can also gain access to each other’s patents, allowing them to more easily create high-demand products. Negative synergy occurs when the combined firm’s revenue is lower than the value of each company operated separately. Synergy is a concept that the combined value and performance of two companies after their integration will increase compared to the sum of the separate entities.

Future Scope of Patient Recruitment Services Market to Observe … – Digital Journal

Future Scope of Patient Recruitment Services Market to Observe ….

Posted: Tue, 08 Aug 2023 14:15:11 GMT [source]

It can be somewhat difficult to estimate because it requires speculative predictions and revenue synergy varies every year. If two merging companies result in a decrease in revenue generation, this is referred to as revenue attrition. The only reason for revenue synergies is the increased revenue after the strategic buyer and target company unite. It is sometimes overlooked that generating synergies is not limited to the sphere of mergers and acquisitions. When it comes to synergies, it’s always better to understate them before the deal. If you think there are $100M of synergies that can be unlocked from a deal between cost, revenue, and financial synergies, it’s good to aim for them.

Create a free account to unlock this Template

If companies can get the management teams from the two formerly separate organizations to work efficiently, then the company can improve its service. As a result of an M&A transaction, the management teams of the two companies rearrangements. This can sometimes be beneficial, and other times be detrimental to the newly combined firm. As an end result of the multiple marketing channels achieved by synergies, hopefully, the company will be able to expand its customer base. Small businesses with low marketing budgets must depend on free or low-cost campaigns to achieve marketing synergy.

Their success depends on the level of competition in their field and their respective geographic markets, as well as the size of the partner company. Mergers & acquisitions and consolidations of teams, groups, and business units are often formed under the pretense of potential value creation from cost and capital synergies, only never to realize those synergies. Cost synergies, related to redundant personnel, are especially difficult to realize since they necessitate laying off or repurposing personnel for different roles. Furthermore, as stated before, the complexity of combining and integrating processes and systems can be overwhelming. One of the best practices in realizing cost synergies is to eliminate one of the entities’ processes and systems, and port over the least amount of critical data to the new systems. Cost synergies are generally created by combining two or more entities and eliminating redundancies, improving scale efficiency, and increasing negotiating leverage over suppliers and partners.

Mergers and acquisitions (M&A) are one of the most common types of restructuring deals, where one company acquires or merges with another. The main sources of synergies in M&A deals are cost, revenue, and financial synergies. Cost synergies come from eliminating duplicate functions, streamlining processes, consolidating facilities, or leveraging economies of scale or scope.

Synergy is the concept that the combined value and performance of two companies will be greater than the sum of the separate individual parts. Synergy is a term that is most commonly used in the context of mergers and acquisitions (M&A). Synergy, or the potential financial benefit achieved through the combining of companies, is often a driving force behind a merger.

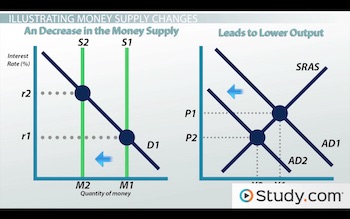

Financial synergies occur when a company’s financial activities and conditions improve as a result of an M&A transaction. As opposed to operating synergies (e.g., cost and revenue), financial synergies primarily occur due to a reduction in the cost of capital. Sometimes revenue synergies occur because the combined firm now has access to a more significant number of products to be sold. It can also happen because the new firm now has more sales representatives and may not have to spend as much on marketing and distribution.

Mergers & acquisitions, partnerships, and consolidations are primarily about by the value created from the synergies between two or more entities. Mergers and acquisitions are the chance for both firms to increase their revenue without increasing expenses. The cost for storage, logistics, marketing research, and training will be lower, as companies will unite their forces and won’t incur additional expenses while attaining better results.